3 Simple and Effective Ways To Fix Your Insurance Agency’s Broken Value Proposition

I recently had the privilege of speaking at TrustedChoice.com/Agency Nation’s first ever digital marketing conference, Elevate, in Milwaukee this past week.

If you weren’t able to make it, it was seriously awesome, and the very first session of the conference happened to be about branding your agency. One of the core topics of the session had to do with building a strong mission statement and brand culture for your agency.

It was pretty cool to see that so many of the strategies I believe in, were also shared by a couple of other well respected branding consultants in our industry, Tony Wessling and Peter van Aartrijk of Chromium Branding.

In fact, many of the things they dove into had already been “written on a napkin” here in this very blog post a week prior, saved in draft-mode until I had time to put some polish on it after the conference.

However when the session concluded, I realized there were also several things I viewed differently, so I wanted to share my thoughts on that because when you talk about branding, it can go in a thousand directions, and quickly become overly complicated.

When you look at the definition of “value proposition” you’ll find something along the lines of —

an innovation, service, or feature intended to make a company or product attractive to customers

a positioning statement that explains to prospective clients the benefits of your product or service, and how it may be unique

A good value proposition is one that is closely aligned with your target client avatar and does one, or all of the following:

- describes the problems you solve

- tells people why they should choose you over competitors

- describes how you are unique

If you’re an insurance agency owner reading this, take a minute and look at your value proposition (if you have one) and ask yourself if it meets these definitions.

Does it meet any of those definitions? Or does it echo the same tired line that many of your competitors are already saying? For many agencies the answer is unfortunately no. But that’s why you’re here right?!

Blah blah blah blah…

One of the (many) challenging things about being an independent insurance agent is that this industry is extremely crowded, with a relatively low barrier to entry. In large part, agents are all selling the same products, from the same providers, with the same marketing message.

This causes consumers to suffer from something called “offer fatigue”.

What is heck is “offer fatigue”?

Offer fatigue is when people literally get sick of hearing the same old thing, to the point where your messaging and/or offer becomes background noise.

Do you want to stand out, or sound literally identical to hundreds of other agencies, some of which are within a mile of your agency?

It’s okay, it’s a rhetorical question. I know you want to stand out. You probably just don’t know how and that’s okay — that’s why you’re reading this article.

Understand the market you’re competing in

Marketplace sophistication is all about what your competitors have already said about similar products or services.

You cannot say the exact same thing as everyone else, and rely on your name or your smile to set yourself apart

It’s not enough. Especially not in 2017. You need a unique mechanism that sets you apart.

I get it — you sell insurance. It’s not fun. It’s not exciting. It’s not intriguing. At least not to consumers. You know this, and I know this, because I too sold insurance and faced many of the same challenges.

That doesn’t mean you should just accept it and follow the herd though right?

The problem with “insurance” value propositions

When I look around at insurance agency websites, there are many common denominators (besides being outdated). Most of the time I see things like:

“We’re independently owned”

“We’ve been in business for 100 years”

“We’re 3rd generation owners”

“We’re local”

“We have great customer service”

Those are seriously all great things that you should value. They truly are and you should absolutely take pride in your business in that way! However…

Here’s the harsh reality…

Most consumers either don’t care or understand what that all means, especially the millennial demographic. What does being independent mean to the average consumer?

I can hear a lot of agency owners disagreeing, saying “No Chris, not true. My demographic values all of those things! How dare you!”

A while back there was a cell phone company who thought they had a loyal demographic too, and never pivoted.

The iPhone came out with a sleek, touch-screen interface, and meanwhile this company, whose name begins with Black, and ends with Berry, was still manufacturing those ridiculous phones, with 732 super tiny, almost impossible-to-tap buttons, with an awkward scroll-ball-mouse-thing.

#scrollballmousething

Their operating system was old school and your fingers had to be pointy like pencils to be able to text your pals.

Lame bro…..lame.

#pencilfingers

But they kept churning out these phones based on what they assumed their customers wanted.

Apple executives were quietly fist pumping as this company’s line of phones was dying a slow death that they themselves didn’t notice until it was too late. Within a few years, their market share was a fraction of what it once was. There are countless other examples.

Don’t be Blackberry!

Don’t tell consumers what you assume they care about just because you care about it

Is it impressive that your agency is 60 years old and your the 4th owner with the same last name? You’re damn right it is. It’s hard to do that in this economy, especially in an industry as competitive as the insurance industry.

Unfortunately, because of offer fatigue, it’s just not something that resonates with most consumers anymore. They’ve heard it a million times.

It’s time to shift your thought process

You need to flush the paradigm that what matters to you also matters to the consumer, from your memory, and focus on what the modern consumer really wants. More on that in a moment.

What’s more, in a case-by-case environment that the insurance industry is, the fact that you’re family owned and/or independent doesn’t mean that you’re better than your competitors anyway.

Does it mean you can provide a better product, or a better price? Not necessarily. Consumers know this too.

I’m really not trying to be harsh here, but it’s the truth. Me, as a former agency owner myself — I don’t even care about half of these things — and that’s saying something. (Don’t be mistaken though, I will always use an independent agent!!)

Understand who you’re dealing with

Understand that the modern consumer is selfish. Maybe even spoiled. They want to know what’s in it for them, because they have options and you need to earn their business.

Modern consumers live in an on-demand world. They expect everything right now, and for rock bottom prices. Literally everything is on-demand from TV, radio, news, you name it.

Consumers expect instant gratification and to make things harder for us, they’ve been virtually brainwashed for decades by the major insurance brands that price is the most important factor in the insurance “transaction”.

Look at Lemonade for example.

At it’s core, their “unique mechanism” and value proposition is speed & simplicity. Instant gratification with purchasing, and with claims. Making the process seamless. Using cool technology to do it is just the icing on the cake.

Do you think consumers care that they give left over profits to charity though? Nope.

Consumers want to know what’s in it for them

It’s easy to take the easy way out but there’s a right way to do it

Industries are competitive so people will do whatever they can to win business, and most of the time, that means a play on pricing.

Insurance companies/agencies large and small are guilty as charged with their price-driven marketing campaigns.

In our industry, companies have this horrible habit of telling the consumer what they want to hear and worrying about the rest later

It’s easy to lead with price because that is the one sure-shot common denominator that virtually all insurance consumers share. But doing so is only further commoditizing what you do.

It’s taking the easy way out and craft our mission statement based on price like Geico, but we’re literally shooting ourselves in the foot every time we do this.

Lemonade isn’t leading with price, they’re leading with convenience, which is smart because in the consumers’ eyes, insurance is one of the least convenient things they have to deal with, especially when experiencing claim.

As agents and agency owners, focus on removing the hassle from the process as best you can instead of purely focusing on rate. That is was consumers care about.

I would pay triple the price if someone came to my house and changed the oil in my car so I didn’t have to drop it off or wait, and basically waste an entire day of productivity. Probably more than triple.

Build your value proposition around what consumers really care about

Here’s what the modern consumer cares about:

- speed and simplicity of purchase transaction

- speed and simplicity with claims process

- price — yes it will always be a factor but don’t rely on it solely

- on-demand availability when they need help or have questions

- overall convenience & customer experience

- technology is the icing on the cake

Here’s the struggle many agencies face: they can’t confidently offer many (or any) of those things to a prospective customer because those things are either out of their control, or are dependent upon technology that they don’t have the desire to learn how to use, or pay for.

And so they resort to things they can confidently speak on. Things like being independent or family owned.

3 ways to fix your broken value proposition:

1.) Re-evaluate how you actually help customers

As an insurance agent, what exactly do you do to help your clients? This is more in-depth than you think. You need to figure out what your strengths are and what you do best as an agency.

What’s more, what is it that you do differently? What is your agencies “unique mechanism”? If you don’t have one, create one, because you can’t tow the same line as everyone else.

Let me give you a head start with some of the basics of how you help people:

- protect peoples’ assets so they don’t go bankrupt if something horrible happens

- allow people to feel safe about themselves and their families knowing that they have adequate coverage limits

- save people money that they can save or spend on stuff they want

- maybe you’re fast, reliable, and provide on-demand service

- does your technology improve customer experience

- you understand insurance so the client doesn’t have to

2.) Audit your book of business

Take some time and go through your book of business. This is good to do for many reasons actually.

You need to know who your customers are, and who you want as a customer going forward so you can speak to that demographic directly with the write messaging, product offering, and value proposition.

You’ll want to uncover several key metrics:

- average age of head-of-household(s)

- gender split

- income

- policy count per-household

- job title/career status

Once you have this information, you can craft a message that speaks to these people, and furthermore, you can identify your ideal client avatar, or the type of person you truly want to serve in your agency.

If the average age of your book is 68 years old, you know that leading with a millennial driven value proposition might not be in alignment with that audience.

You need to figure out who you want to do business with and speak directly to that person with things they care about. This leads me to the next point —

3.) Worry about what the consumer wants, not you

We talked earlier about what really matters to the modern consumer. Build your message around that, and whatever you do, don’t lead with price. I know it’s hard, but just don’t….do……it.

We know price is one of the common denominators that insurance consumers share, but so is convenience and customer experience.

No one likes hassle. Build on that instead of telling people you’re a 3rd generation agency owner.

What you need to know about value propositions and SEO

One of the things that wasn’t really touched on in-depth during the branding discussion was how a value proposition should actually fit in with your insurance agency’s website.

If you truly care about your insurance agency’s SEO (the visibility of your website in search engines), and rely heavily on organic search engine traffic for online lead generation, I do not recommend leading off with your value proposition (on your home page) and here’s why:

People don’t search in Google for value propositions.

If you want to make sure your site is as SEO-friendly as possible, you need to make sure that the main H1 title tag on your home page contains keywords, not a value proposition.

Is this going to make or break your website? No, but again, people don’t search for value propositions and tag lines.

At Advisor Evolved, we get push-back on this from time to time when we’re setting up websites because customers want to use a value proposition or other tag line instead of keywords. Once we explain it to them, you can see the light-bulb go on in their head(s).

If you’re going to have the value proposition on your home page, make sure it’s either an H2 or H3 sub-heading.

Pro Tip: I recommend putting it on your “About Us” page, so that you can use the space on your home page for more targeted content and keywords.

Your home page is the most important page on your site so you don’t want to waste space on anything that doesn’t help people find your site, and/or convert.

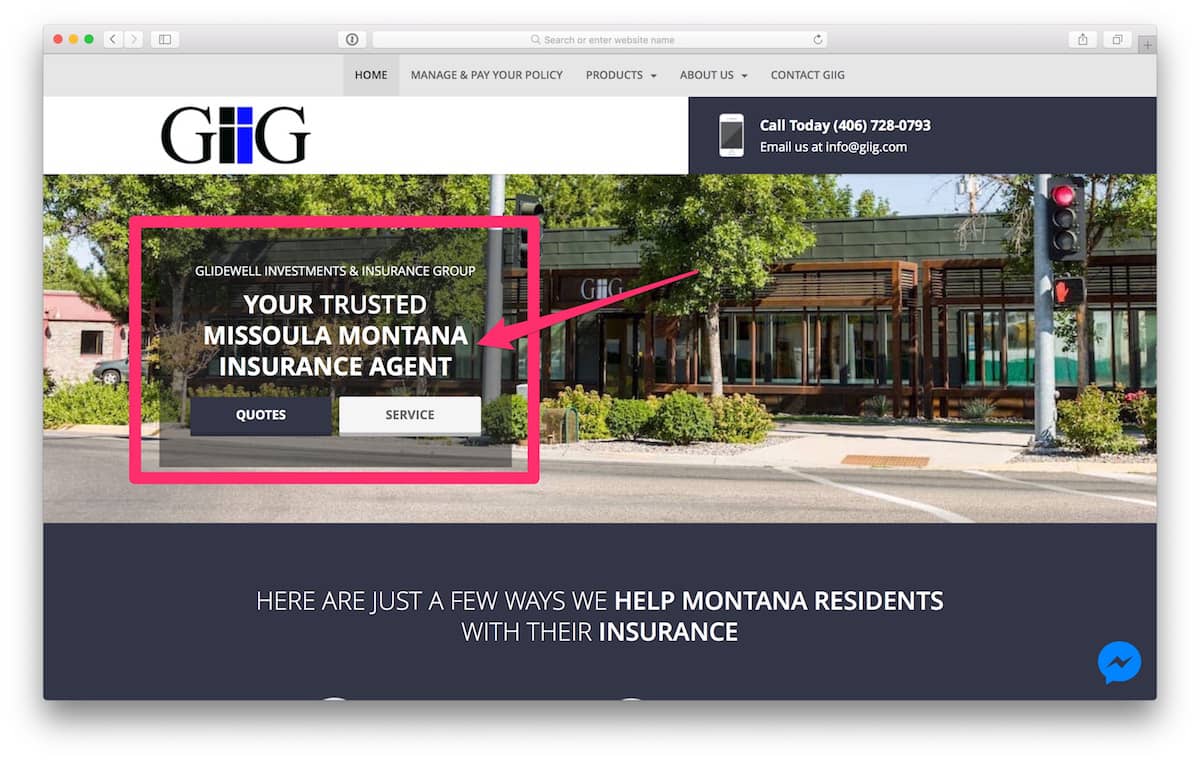

Here’s an example of what I’m talking about, notice how the main H1 is not a value proposition, but a keyword:

Having a great value proposition is awesome, but no one is going to see it if they don’t find your site to begin with.

What to do next?

I would encourage you to make some time, sit down with a pad and a pen, and map all this out. Yes, it’s going to take some time to do, but do it. No excuses. The blueprint is right here. Just read this article again if you get stuck.

Understand that you’re in a competitive industry. Don’t leave this type of thing to chance.

Don’t assume that you can survive on your name, and with the same message that everyone else is pushing.

The key to survival in an industry like this is finding your unique mechanism, and making sure consumers understand what it is.