The evolution of the insurance agency cluster relationship

For many independent insurance agencies, surviving in one of the most competitive industries in the world would simply not be possible without agency alliance networks, also known as clusters.

In an industry where captives are leaving to become independents, almost daily, and younger agency owners are entering the market, these groups are becoming more important than ever before.

There is no doubt that clusters are crucial to the growth, and long term sustainability of the independent agent distribution channel.

With that being said, it’s my opinion that these clusters could be doing more for their agency partners. They should want to, because helping their agents is helping themselves.

After all the time and money it takes to recruit and build relationships with agency partners, it only makes sense to take a more well rounded approach to their development.

Here’s what I mean…

While many of the existing (and more mature) agencies have been able to grow their business over the past 20 or 30 years with more traditional methods, being able to pivot and adopt customer acquisition strategies that more closely align with modern consumer purchasing patterns has proven to be a huge and often insurmountable challenge for many agencies.

Agencies need to know how to capture the attention of one of the biggest, and soon to be the most influential demographic in the world — millennials. It’s a game that agents and clusters alike aren’t used to playing.

Both sides need to learn fast though because at the end of the day, insurance agents aren’t in the business of selling insurance, they’re in the business of marketing.

When it comes to marketing, many agencies are on an island, fending for themselves against national brands who spend billions of dollars each year pushing a message that is commoditizing a product (personal lines) that has been the backbone of thousands of independent agencies for decades.

So what can clusters and agency advocate organizations do about this? What should they do? Is is their responsibility? I think to a large degree it is.

I recently had the opportunity to speak with a group who is well past their “ah ha” moment, and onto the “let’s get something done and help these folks out” phase:

I love when people genuinely want to help independents instead of just selling them stuff. Good talk today @aubieknight @TheBigI_NC

— Advisor Evolved (@advisorevolved) January 5, 2016

We recently spoke to Aubie Knight, CEO of the IIANC about this topic. Make sure to watch the video below, and you can also listen to the audio version on our podcast page, as well as in iTunes, Stitcher, or Google Play.

Carrier access is only the beginning

It’s just like I tell our website clients sometimes if they ask about leads and traffic — a website is only one variable in your online success. You need to understand how to use the website as a sales and servicing tool, or it will be no better than a billboard on a deserted road.

This is why our clients have access to a marketing dashboard that teaches them every thing they need to know so they can survive and thrive online. Handing someone a new website is only half the battle.

If you’re a cluster reading this article, you might already know this, but your job isn’t done by helping an agency get some direct codes, or a discount on their agency management system.

If you think it is, you’re missing the bigger picture, and, leaving money on the table in the process.

Don’t get me wrong, carrier codes are obviously huge, overrides are great, and software discounts are a nice sweetener, but in 2016 and beyond, I think agencies need more to grow.

Agents need more to thrive:

Practice what you preach

If you’re going to preach growth and stability when you’re recruiting agency partners, should it not be part of your duty and responsibility to help prepare agencies for the monumental shift that is occurring?

Maybe a more important question: do you know how to prepare yourself?

As more tenured agency owners retire and sell off, you’re going to be dealing with a totally different kind of recruit pretty soon — if you can connect with them in the first place.

Reaching millennial agency owners is going to be a thing going forward.

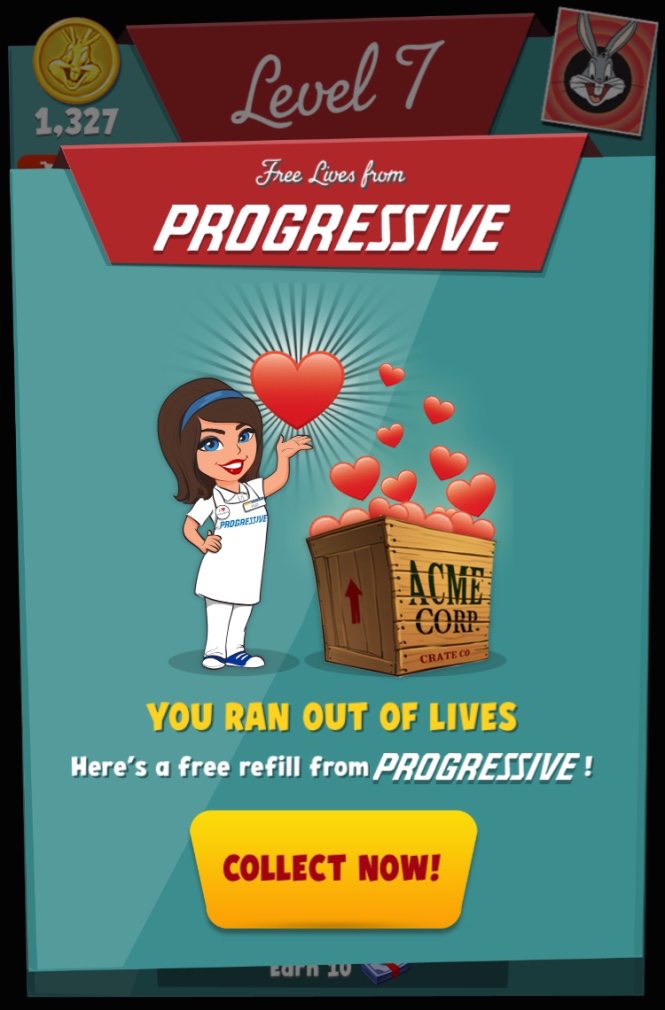

I recently saw a great example of a company that “get’s it” when it comes to millennial marketing. We all know about Progressive Insurance’s Flo, but did you realize she is being marketed to children?

Progressive Insurance understands the game.

Instead of grabbing the low hanging fruit, they’re putting their work in now, and planting their marketing seeds with the youngest age demographic out there — a population who won’t have the need for insurance for another 10-15 years.

They’re not just marketing to millennials, they’re marketing to 2 generations before them, so they can reap the benefits later. It’s a long term play, but one that is building their brand equity with an age bracket that is very impressionable.

This is the type of second level thinking it takes to build your brand, and network for the long haul.

The following pictures are screenshots of a few of their ads that I found when helping my 7 year old son navigate a children’s spelling app, and a Looney Tunes game on his iPad:

Before I could click the little “X” to kill the ad, he laughed and asked me who it was. If my 3 year old saw it, he would have asked where I could buy him a toy “Flo”.

Could this type of approach help clusters attract young agents? Possibly.

Could it help insurance agents attract life long customers who were essentially born into their brand? Definitely. It’s already happening.

Well played Flo, well played.

Change is a coming

The shift that’s occurring is like a disease that you can’t see, hear, touch, or feel. You know you have it, but because it hasn’t impacted your day today, you dismiss the notion that it’s a real problem.

You can ignore it if you want to, but one day you’re going to wake up and get the worst news of your life.

There needs to be a sense of urgency from carriers, clusters, and agencies if the independent channel is going to remain stable.

There needs to be value beyond carrier access.

Speaking of which, I’ve seen 100x more value being a member of this private Facebook group (which is on it’s way to something much bigger) than I have from any other group, or agency alliance relationship I’ve ever had, and I’m not the only one echoing that sentiment.

(Side note: If you’re in independent agent, click that link and ask to join now. It’ll be the best thing you do all day.)

Is that sad? Maybe, maybe not, but it just goes to show you how millennials like me operate.

We live online, and this behavior is becoming more and more ingrained into the DNA of modern consumers.

This is only one man’s experience, but when an agent turns to Facebook for advice instead of the organization that helped bring them into the business, I think it’s very telling of the current state of cluster/agency relationships.

Be proactive with agency partners

Maintaining a relationship with an agency partner is no different than an agency maintaining a relationship with an insured.

Being reactionary is the beginning of the end — a silent deterioration of the relationship.

Customers don’t leave an agency because of price, they leave because of lack of communication.

Holding a webinar a few times a year, a random training session, or sending a few emails that talk about marketing, or agency development is not enough in my opinion.

Some agents need to be interrupted — forced into taking action. Agents need to be accountable too though.

It’s my opinion that agency alliances need to be aggressive, and progressive in helping agencies with the other areas of their growth plan if they want to maintain a healthy network of agency partners.

Things like:

- Digital marketing & SEO

- Business planning and succession

- Hiring & Producer Compensation

- Software & Hardware tips

- Agency guidelines & best practices

Just like taking a licensing exam to sell insurance is mandatory, there should be mandatory business development and marketing classes for agencies as well when they become a member of a cluster, or even after they’ve been in business for a while.

The independent channel is already a decade behind the curve when it comes to marketing (especially digital marketing), and in the millennial driven world we’re headed towards, agencies need actionable advice, accountability, and most importantly, help with execution.

Don’t leave it up to carrier programs and agents themselves. Take things into your own hands, because the landscape isn’t just changing for agents, it’s changing for you too.

Rest on your laurels, and leave agents on an island at your own peril.

Competition is everywhere, including Facebook groups.

Conclusion

Running an insurance agency in 2016 and beyond isn’t the same thing as running an agency in 1996.

The same can be said for operating a cluster.

I might not be telling you things you don’t already know, but if you’re a cluster, or agency alliance group, and don’t know where to begin, Advisor Evolved may be able to help you.

If you’d like to discuss ways to help your member agencies grow faster, check in with us and let’s see if we’re a good fit for what you’re trying to do.

One thing is for sure though, if you’re laying back doing the same thing over and over again, expecting a different result, while the world is changing around you, well, you know what the definition of that is right?