Let me preface the following article with a couple interesting facts:

- 90% of all purchasing cycles begin online

- 70% of those people use online reviews to make their purchasing decisions

Getting online reviews for your agency in Google is an absolutely critical strategy. It helps you in so many ways. It helps your agency website rank higher in search results. A website that ranks higher in Google will show local insurance consumers that your agency is a local authority, and it will also greatly improve your chances of getting leads from your website.

Surprisingly though, a lot of the agencies we consult still do not have any — not even one online review. Most of the time it’s because they simply aren’t asking their customers for reviews, which of course, is a big no-no.

Other times it’s because they are asking, but they’re doing it wrong. So, if you want to know how to get more Google reviews of for your insurance agency, this one’s for you!

How to get more Google reviews for your Insurance Agency

Step 1: Ask for reviews at the right time

Timing is everything here. Asking for a review 3 months after someone has become your client is not very effective. You need to do it within the first 24-72 hours while they’re still all warm and fuzzy about their experience with you.

Ideally, you’ll want to ask them right at the point of sale. If they are physically in your office, you could turn the computer towards them, or let them sit in your seat to do it right then and there.

Pro Tip: I’ve also seen local businesses have an iPad or other tablet on the counter, so customers can check-in on Facebook or Foursquare, and also leave them reviews on the spot. This is not only easier, but to the customer, it just feels easy and forward thinking. Give it a try!

Step 1a: Guide them through the process

If you feel like you’re pressuring them to leave the review right then and there, you could also physically hand them a worksheet or guide like this one, that shows them how to do it on their own when they get home. Just know that the chances of them leaving a review decrease if they leave your office without doing it.

Honestly, you shouldn’t feel like you’re pressuring them. You just helped them out a ton! You need to be confident in yourself in that moment. Like my Grandmother always said, “closed mouths don’t get fed”. So don’t be afraid to ask them.

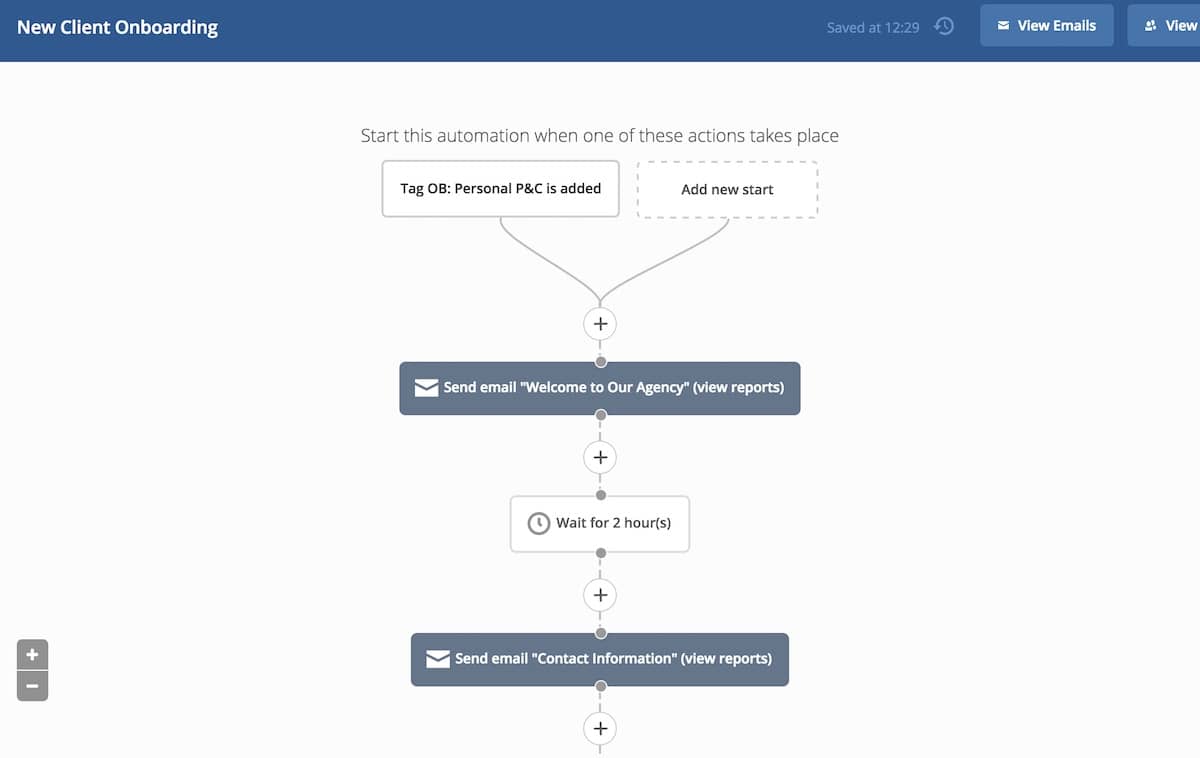

If you don’t typically have people come into your office, you could email your clients the worksheet, or, if you’re using an email automation tool, you could automate it by adding this step into your digital on-boarding sequence. Boom!

At Advisor Evolved, if you’re in our Premium Plan, we give you pre-built automation sequences like the one mentioned above that you can use to plug-and-play. In our on-boarding sequence, there’s an email that prompts the new customer for a review, and points them to a page on their website that shows them exactly how to do it, like this.

Here’s what the on-boarding automation looks like:

Using an automation allows you to essentially “set it and forget it”, however you still need to get people into the automation, which depending on your agency management system, could be a manual process, although a quick one.

Step 2: Follow up with the client if they don’t leave the review

Don’t view this as you nagging the client. You just helped them out in a big way, so don’t be afraid to nudge them if they don’t leave the review right away.

It could be a simple email like, “Hey _______, just a quick heads up, online reviews help us a lot so if you haven’t already done so, would you mind taking a minute to leave us an honest online review?”

Normally that’s all it takes to get them to do it.

Step 3: Respond to your reviews

When local insurance consumers see that you’ve taking the time to respond to your online Google reviews, they know that you truly care about your customers, and thus, are much more likely to engage your brand online, and/or do business with you and send you referrals.

Step 4: Google reviews are all that matter

Folks listen — Google has a 90%+ market share in the U.S. for search.

When people search for services and products, they are using Google. Not Bing. Not Yelp. Not even Facebook.

Google reviews are quite simply the only reviews that matter.

They’re really the only reviews that have a bearing on your SEO and online authority — period.

I mention Yelp in this article, but truth be told, Google is way more important. Google has all the power and users, and consequently, you should be focusing your energy, and your insureds’ energy on Google reviews.

Yelp and Facebook reviews are cool, but Google reviews again, are all that matter for SEO and conversions. Should you be getting review on Yelp and Facebook? Yes. But if you had to pick one, pick Google reviews.

Speaking of which…

The impact of online reviews on Insurance SEO

We talk a lot about insurance SEO here at Advisor Evolved, and one of the major metrics that Google is now supposedly taking into consideration is CTR. CTR stands for Click-through Rate, and is essentially the rate at which people see your website in a search engine result page (SERP) and actually click through to the website.

The more people click through to your site, the more priority Google will apparently give to your site (which means that the on-page SEO — meta description and title tag must be optimized) (P.S.A.: don’t believe every little you hear from Google; at least not initially).

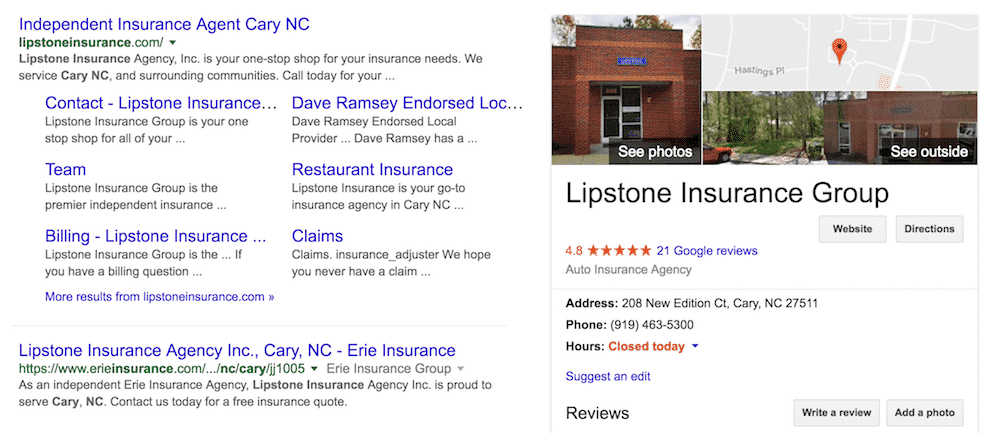

If the CTR SEO boost is a real thing, which in time it could be, online reviews (especially Google reviews) will impact your CTR, and thus your SEO immensely. The way it works now, once you have a decent amount of reviews (usually 15-20 reviews) Google will display a star rating next to your url in the SERP as well as your “local box”.

That star rating can single handedly make people click on your domain, thus leading to conversion opportunities and higher rankings in search.

Like this:

What’s more, in a survey done by American Express back in 2011, they found that one positive review leads to on average, 9 referrals. Nine referrals folks! This is the power of positive reinforcement, and shows you that online reviews can have a very well, “offline” impact on your business.

What not to do when it comes to online reviews

Don’t ever link someone directly to your review page

Google and Yelp are notoriously vigilant against false/forced reviews. They actually have very strong filters in place and they know when a review is bogus, or provoked, and they will straight up block the review if you do this.

Do not link someone directly to your review page and do not pay, or incentivize people to leave you a positive review. Make sure they search for your site organically in Google/Yelp like you saw in the example above.

Don’t ask for reviews in bulk

Don’t ask 300 policy-holders to leave you a review at the same time. Spam city! Try not to ask for more than 2 or 3 reviews per week. You want it to look natural to Google/Yelp, otherwise it’s going to look shady.

Don’t push for “positive” reviews

Don’t ever ask someone for a 5-star review. Just don’t. It’s going to feel shady to them, and honestly, you want honest online reviews. In fact studies have show that when a company has a less-than-perfect review score, it seems more believable and authentic.

Just ask for an honest online review, and let your work and customer experience do the talking.

Conclusion

If there was only one thing you could do to improve your online visibility, Google reviews is it. Trust me when I tell you, blogging/SEO is just as important, and the reality is, you need to do both to build your book, brand, and authority online.

You have to understand that when people search for service providers like insurance agents, they are searching online, on a local level. Google reviews will help you tremendously in this area!

So what are you waiting for? Go ask some insureds for reviews. Do it now!

But only 2-3 per week 🙂

How to On-Board New Insurance Clients Like a Rockstar

How to On-Board New Insurance Clients Like a Rockstar