How to On-Board New Insurance Clients Like a Rockstar

Have you ever sat down and actually strategically planned out your agency’s on-boarding process for new customers? It’s probably the single most important process or procedure your agency could ever develop and execute on.

If you haven’t gotten that far, or you have, but aren’t quite sure what you’re doing, today is your lucky day, because we’ve created a step-by-step blueprint that you can follow right now to improve your new customer on-boarding.

Ready to dig in?

What exactly is On-boarding?

Before we tear this process down and rebuild it, let’s identify exactly what on-boarding actually is, so that we have a frame of reference as we go through this blueprint.

For all intents and purposes, and as it relates to the insurance industry, on-boarding is the process of welcoming and acclimating new customers to your agency or firm, and more importantly, conditioning them to the way your agency does things.

This process can quite literally make or break the future of your relationship with your client(s), as well as impact your chances of getting referrals from them.

And we all know that in this business, relationships = revenue.

Where does On-boarding actually start?

Understand this folks: On-boarding your insurance clients doesn’t start after you’ve made the sale.

Have you ever heard the quote, “There’s no second chance at a first impression”.

It’s true. The on-boarding process starts with the very first impression.

It starts during the very first conversation you have with your client or prospect. This conversation is a crucial one that sets the tone for not only the sale, but the future of your relationship with the client.

On-boarding the right way can turn a price-conscientious consumer into someone who rarely looks at their monthly bill, much less their renewal statement.

How to on-board effectively

This is not to say that the way you are doing it now is dead wrong. A lot of the agencies we talk to are doing a lot of things right. With that said, on-boarding is very much psychological, so there has to be a certain flow to your process for it to really have the desired effect on your new client.

The first 60 days of the relationship are crucial.

This is where you get to show the client that you are detail oriented, attentive, and maybe above all else, human. You need to come across as “one of them”. More on that in a bit.

The Insurance Agency

On-boarding Blueprint

This process could obviously be customized around your team and staff, but every on-boarding process should follow a framework like the one we’ll discuss now.

As we mentioned above, it all starts with the very first conversation.

Engage them during the “Discovery” conversation

If you’ve ever seen Ferris Bueller’s Day Off, you remember the monotone, dull, boring voice from the teacher, played by Ben Stein. Don’t be this guy folks.

When I worked at AIG in the early 2000’s, I learned many valuable selling skills — maybe the most important was how to use my voice as a tool to communicate with the prospect.

The way you answer your phone matters folks. If you haven’t already, you should re-evaluate how you and your staff are taking calls from prospects and clients.

At AIG, they were very big on training their reps to greet the prospect in a way that was professional, polite, and shall I say, authoritative, but without being salesy. Our call quality scores weren’t just based on whether or not we asked the right technical questions, but how we actually came across to the prospect.

AIG understood the value and power of how you verbalize things to people, which is something I believe many sales organizations overlook.

What’s funny is it was their on-boarding program taught me that when you’re talking to someone on the phone, you’re only appealing to one of their five senses, so you need to let the other four senses live vicariously through your voice if that makes sense.

The tone and attitude of your voice throughout the initial conversation (and any other sales or service conversation) is absolutely critical for the rest of the call, and relationship.

Conditioning Your Prospect

Obviously throughout this call you’re going to be getting coverage and rating information from the prospect for the quote, which to them, can be a daunting process. You know as well as I do, that most prospects barely know the make and model of their car, much less what their un-insured BI limits are.

You need to prepare them for this “interview” and be empathetic, because chances are they’re going to hate this part of the process a little bit.

What’s more, you need to tell a positive customer story you’ve had with another customer to humanize yourself, but also show the prospect that other people have had a good experience with your agency. This social proof trigger is extremely important for many reasons, and can in many ways be the sole influencer in their buying decision.

One of the characteristics I believe makes a truly great salesperson, is the ability to talk on the consumers’ level. In other words, you need to understand when to let down (and elevate) the wall of professionalism sometimes. The way you talk to a plumber is probably very different than how to talk to a corporate executive.

Great salespeople are authentic chameleons.

Social Proof (Testimonials)

This is an important step in the process — before you follow back up with them on the phone, you should show them some more social proof. Send them an email or a text with a link back to wherever you have the most customer testimonials.

You’re asking for online reviews right? They are huge for local SEO. If not this handy guide we made should help you get more reviews. You can email it out, or include it in a physical welcome kit. We’ll also show you in a second how to ask for reviews in an email automation sequence.

Ideally, you would send them back to a page on your website like this, but sending them to your Google or Facebook reviews would also work.

Really, you’re simply trying to get some positive reinforcement in front of them before your next interaction. Here’s an example of what that email might look like:

“Hey ______, I know it hasn’t been too long since I sent you the quotes for your insurance, and you may not even have had the chance to review them yet, but I just wanted to quickly link you over to some of the recent reviews left by our awesome clients!

[insert link here]

Thanks! Hit reply if you have any questions about the quotes, otherwise, I’ll give you a call in a day or two.

Take care!”

That’s all it needs to be. Simple right?

Quote Follow Up

If you don’t bind coverage on the initial discovery call, your follow-up is critical — not only so you can eventually get the sale, but it sets off a phycological trigger in the prospect’s mind, that “oh, this person is pretty attentive; if I ever had a claim, this is how they would handle it”.

You know as well as I do that attentiveness is a must-have quality of any good insurance agent, and the initial follow up should be done both physically (phone) as well as via email in my opinion. We’ll elaborate on that in a moment.

Policy Issuance

Assuming you sell the coverage, the policy issuance phase is yet another opportunity for you to show your worth to the client.

Important: Just because the client agrees to go with your quote, doesn’t mean they are truly “sold” mentally. It also doesn’t mean you should blow through the actual sale either.

A crucial step during the final sale is some additional “pampering” of the client before you bind the coverage.

“I know we went through a lot of information to get to this point, so before we initiate the new policies, are there any other questions, or concerns you have? I just want to make sure you have all your ducks in a row.”

That one question shows the client you truly care, and 9 times out of 10, they will actually need reinforcement on certain things you discussed, so it’s a win-win question to ask.

Asking for Referrals

Not referrals. Just one referral. During the point of sale, it’s also imperative that you thank them for their business and ask them for a referral. This is when they are the “warmest” and most open to that discussion.

About 10 years ago, our firm hired a professional marketing and referral consultant named Dan Allison, who among other things is known for his Feedback Marketing techniques.

The concept behind Feedback Marketing is to run focus groups with existing clients, — asking them for real feedback on your agency, business, and processes. It’s really a psychological ploy to get them closer to your brand, so they trust you more, and send you more referrals.

One of the points Dan made was, you need to make it “mentally easy” on the client to send you business.

When you say, “Don’t forget to tell your friends and family about us”, in the customers mind, that seems like a lot because you’re asking them to send you multiple people.

Instead, try this:

“As you might know, referrals are a big way we grow, so even if you only tell one other person about us, we would greatly appreciate that”

Telling one person is a much easier task mentally, and because of that, they’ll most likely end up telling more than one person anyway.

Physical Welcome Kit

Look folks, I’m as “digital” as they come, and for as much as I talk about the “new” way of doing things, I still believe there is tremendous value in physical welcome kits. Make sure you mail your kit out no later than 48 hours after the policies have been issued. You want to catch them when they’re warm.

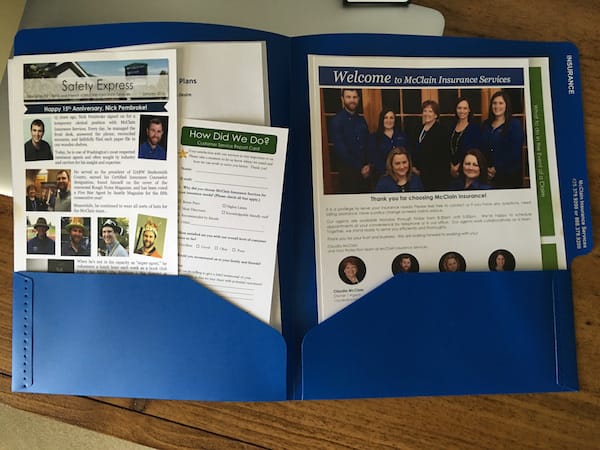

I’ve seen many of them in my day, and actually designed a few myself, but there might not be a better one out there than the one created by Claudia McClain and the awesome team over at McClain Insurance.

Welcome Kit from McClain Insurance

Physical welcome kits are a great way to give people a tangible piece of your agency that they can hold and feel in their hands. As I eluded to earlier, a big part of sales is applying yourself to the consumers 5 senses. I talked to an agency once who actually sprayed their letterhead with a shot of perfume, so when the customer opened the welcome kit, it actually smelled nice!

Call it crazy, but that is the type of thing that differentiates you from other agencies and makes a more impactful impression on the customer.

Here are a few must-have items you’ll want to include in your welcome kit:

- Meet The Team/Employee Bios and….

- Family pictures of your staff!!! (humanize your brand folks)

- Refrigerator Magnet with Agency Contact Info

- Business Card(s)

- Survey (Positive Reinforcement mechanism)

- How to Report A Claim Info

- Referral Rewards Program info

- ID card holders for auto policy

- Other promotional items like pens, magnets, key fob, calendar, etc. (I’ve personally used Manko Company for these types of items and have heard many great things from other agents about them as well )

Where McClain Insurance went above and beyond, is they used a plastic folder, as opposed to a paper, or sturdy-stock type of paper/cardboard material for the actual folder that the welcome kit is delivered in.

There is just something about paper mail and folders that makes us want to immediately throw them in the trash. A plastic folder is sure to stick around much longer, and can be re-used by the customer for other filing purposes.

Digital Welcome Kit Sequence

As important as a physical welcome kit is, just as important is the digital version.

The truth is, now a days it’s easier to become engrained in someones life digitally than it is physically. A physical welcome kit, while important, has a shorter shelf-life than that of a digital sequence.

Speaking of sequences, the absolute best way to execute your digital welcome kit, and further condition your clients is with automation. Depending on what agency management system and/or email service provider you use, setting up a pre-written automated sequence allows you to put much, if not all of your on-boarding process on auto-pilot.

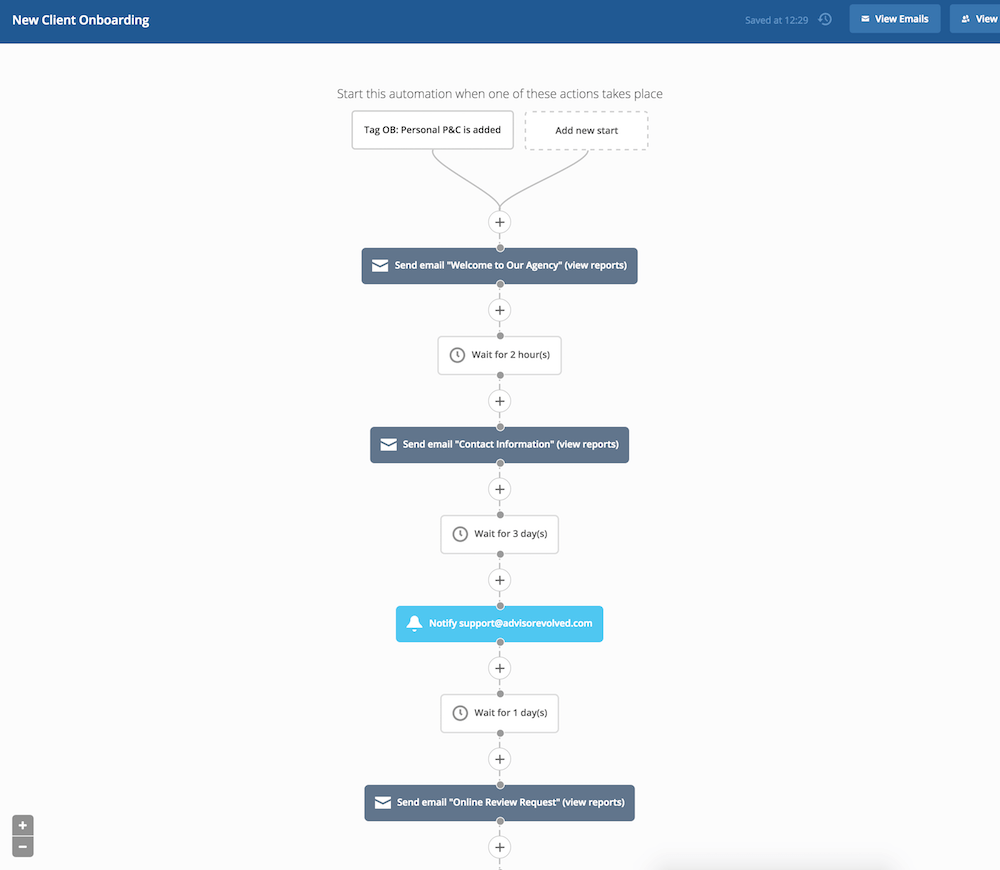

Unfortunately, there are few, if any agency management systems that do this well as we sit here today. If you’re an Advisor Evolved Premium Plan Subscriber, we actually build and give you these types of automations so you can plug and play right away using a tool called Active Campaign.

Here is what a basic on-boarding sequence looks like:

You can’t see the entire sequence, but there are multiple touch-points that span a period of about 3 months, including internal notifications for CSR’s and producers, all on auto-pilot. The great thing about these types of sequences is, you can customize them to fit your preferences. If you want them to go a full year (or more), you can easily do that.

What’s more, you can track when someone clicks on a link that you include in one of your emails, and fire another automation sequence based on whether or not the person clicked that link or not.

The possibilities are literally endless, especially when you introduce conditional logic to the automation equation (we help with this if you’re a client).

It’s a truly amazing tool that is highly approachable both in terms of cost, and user experience.

Here are just a few things you can do with a digital sequence:

- Ask for online reviews

- Ask for referrals

- Ask for social follows and shares

- Share helpful blog articles from your agency website

- Cross-sell other products

- Agency notifications/alerts

- Ask clients to complete survey

- Calendar based emails (Christmas, Birthday reminders, etc..)

Again, the possibilities are truly endless with an automation sequence.

The great thing is, automation is not just for B to C communication. As I mentioned a second ago, it’s also a tool that can automate internal processes, like alerting a CSR to call a client if they click a link in a certain email. Pretty cool right?

Physical Follow Ups

A lot of agents don’t do this because it takes time, but you should really pick up the phone and call your new customer within the first two months of selling them their policies.

Ask them if they have any questions, and if they don’t, just let them know you were calling to check in with them. After two months, the client has most likely mentally back-burnered the experience they had with you when you sold them the policies.

This simple, strategically placed phone call, will do two things:

- Absolutely blow their mind because no other agent has ever been this proactive and/or caring

- Bring your brand back to the front of their memory bank (referrals)

Some people might say, “our clients are going to get sick of hearing from us”, and that actually might be true depending on who your avatar client is, but believe me when I tell you, you cannot rest on your laurels in this industry.

You must be proactive in this business.

Becoming a “reactionary” operation is the beginning of the end for your agency or firm. Being reactionary is literally a disease that builds inside your business, and slowly eats away at all the work you’ve done to get to where you are.

We can talk about value and coverage until we’re blue in the face, but the fact is, you are in an industry that is in many ways commoditized in eyes of the consumer. What’s more, lack of communication with your book can actually be a liability both legally and financially to your business.

In many cases clients expect us to be mind readers. They think we should have automatically known that their daughter and her husband and 3 kids just moved back into their house with their 2 cars and trampoline.

Differentiating yourself from competitors is becoming harder and harder, and as much as you may think your cheerful and up-beat staff is winning over clients, you’re not the only team with this quality.

But you could be in the small percentage of agencies who are over-the-top proactive with their book, and that will be what separates you from other experiences your customer has had.

This brings me to my last point —

In Closing & The Cost of Being Proactive

Folks: it costs money to be proactive.

Being proactive takes time, and time is money, so staff accordingly because the cost of staffing yourself to be proactive is a cost of doing business.

This business isn’t for everyone is it? Heck, this process isn’t for everyone, but if you make the time and execute on this process in the beginning, it will feel like an experience to the client, not just another transaction — and that is the true power of doing this.

On-boarding is something that isn’t totally necessary in every business, but the insurance industry is far too competitive to rest on your laurels.

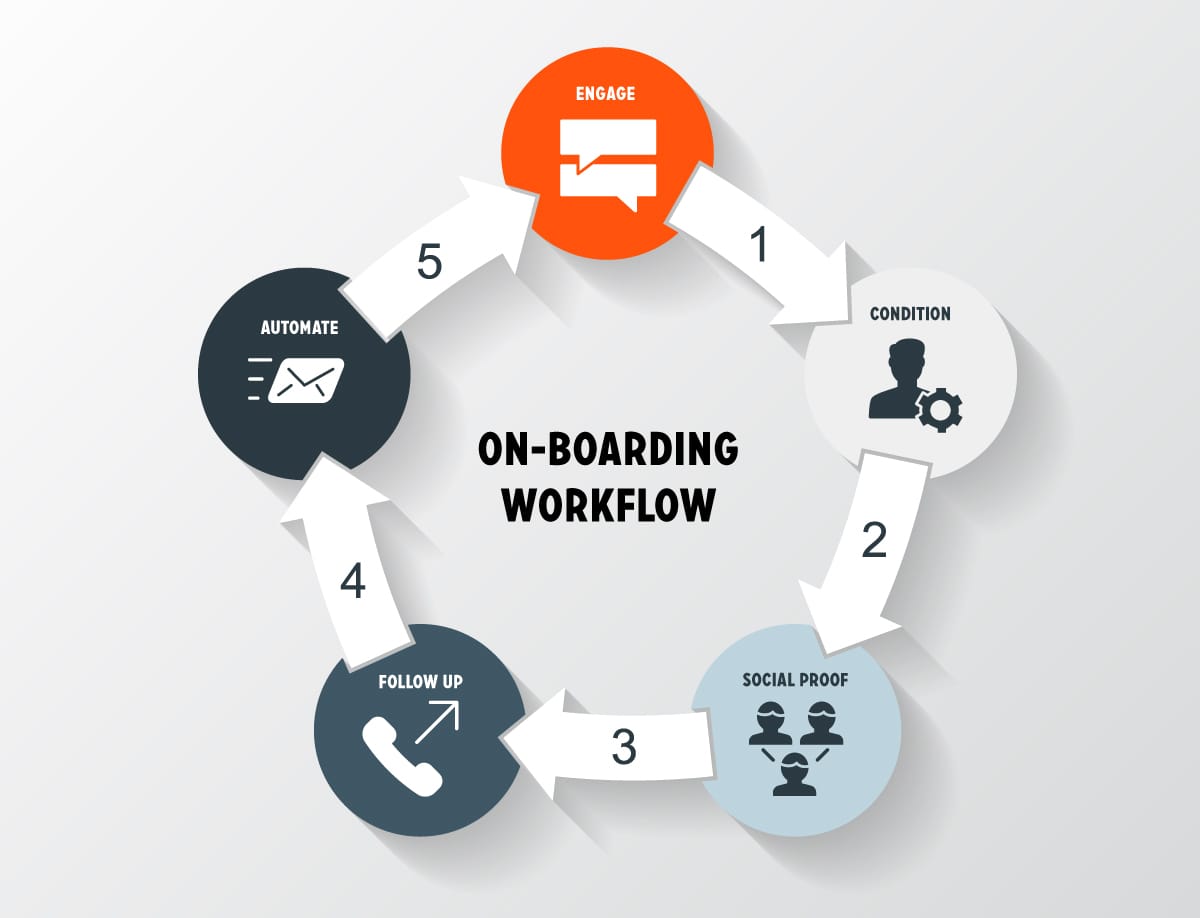

Just remember — engage; condition; social proof; follow up; automate. If you can do that, you’ll build better relationships with your clients, and again, relationships = revenue.

Hopefully this has taught you a thing or two, and if you have anything to share, or a question, please leave us a comment below!